Does Corporate Research Still Matter?

In January 2015, IBM and one of its clients, candy maker Mars, announced an ambitious plan to dramatically improve food safety. Rather than merely testing food samples for common pathogens, they will go deeper, gathering and classifying the DNA and RNA found in the samples. Then, by analyzing the environment in manufacturing plants (and eventually on farms, warehouses, and other places in the supply chain), they will try to determine when and where dangerous bacteria and viruses tend to grow. The eventual goal: to give food workers and health regulators a better idea of what triggers contamination and, perhaps, a chance to predict food safety problems in advance.

The focus on collaborative research with clients, a key factor in this project, is itself new, IBM says. Working together this way can be riskier than doing research alone and then translating lab success into a product for the market. “There is no certainty that what you are working on together is actually going to have a result,” says Arvind Krishna, director of IBM Research.

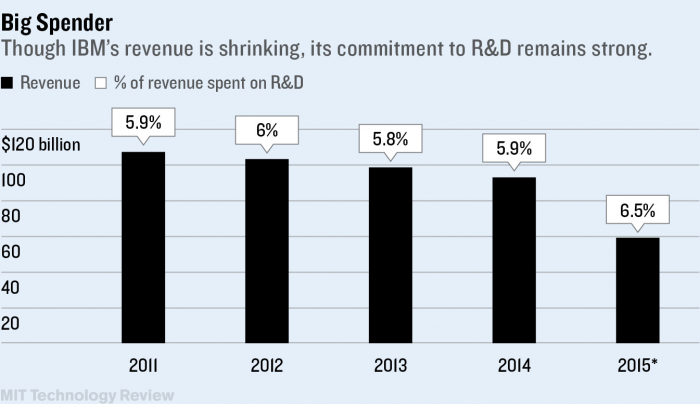

IBM has long espoused a focus on getting closer to clients, but if it embraces this joint research approach, that could be a crucial contribution to IBM’s revenue, which has dropped year over year every quarter for the past three-plus years as the company sells off businesses and struggles to compete with the cheap cloud computing services that have eroded the need for the company’s traditional data hardware.

If it doesn’t work, it may be harder for IBM to continue to fund research at its historical rates. If IBM Research doesn’t clearly contribute to the profits of the company, says Paul Horn, former director of IBM’s global research and now senior vice provost for research at New York University, “it will go the way of many research organizations.”

Which is to say, away. Centralized corporate research has largely gone out of vogue in recent decades, with corporate spending making up a declining share of all R&D expenditures. So far, IBM has bucked that trend and maintained its commitment to doing basic research, funding 3,000 scientists working in 13 labs across six continents. The company spent $5.4 billion on research and development in 2014, 6 percent of revenue, and continued at a pace of 6.5 percent through the first nine months of this year.

IBM’s research hubs were once modeled on academic-style ivory towers. Today, the company says, researchers are being pushed out of the lab and into client meetings. Aiming to speed up research and focus it on customer problems, the company’s researchers have worked on more than 300 projects with companies like Mars over the past 18 months. Today, Krishna says, between one-third and half of all his researchers meet with customers on a regular basis.

Some of the work done during that ivory-tower period was revolutionary; IBM scientists won Nobel Prizes in the 1980s for their discoveries in superconductivity and nanotechnology. As recently as two decades ago, more than half of IBM’s lab work focused on materials, physics, and what Krishna terms “the bowels of hardware.” Today that’s dropped to maybe 25 percent, he estimates. Research is no longer organized by scientific disciplines such as chemistry or applied math but instead centers on technological applications, including cognitive computing and the uses of data in industries.

This is not the first time IBM has tried to make profits from research. A decade ago it launched an ultimately unsuccessful program selling R&D services to clients. Krishna says this time is different, because by working with multiple clients, researchers can spot patterns around which businesses can be built.

Once IBM’s research hubs were academic-style ivory towers. Today, the company says, researchers are being pushed out of the lab and into client meetings.

The research group’s biggest recent success has been Watson, the computer learning technology that won the trivia game show Jeopardy! in 2011. IBM has earmarked $1 billion to develop Watson, and in early 2014 it made the technology its own business line, complete with a newly built headquarters in New York’s Greenwich Village. It reportedly hopes for annual revenue of $1 billion by 2018.

Watson is not the result of the kind of collaborative research IBM is now espousing—it was born from what the company calls a “grand challenge,” a tradition within the company of focusing on a particularly hard problem and trying to solve it. But executives hope Watson will increasingly be a tool in these customer collaborations.

It has been used to study certain topics in depth, such as pollution in Beijing or medical research into the best way to treat cancer patients, but IBM expects to make it applicable to many different fields, expanding the types of data it can process from text to images. The company has even begun to research how Watson might come to understand gestures and other forms of nonverbal communication that are currently beyond the capacity of artificial-intelligence systems to decipher.

The research with Mars is part of an initiative called THINKLab, in which IBM scientists selected for their specific expertise aim to help clients make the best use of their data. It is an inordinately complex task to sort through the huge amount of data on the microbiology and chemistry of food and its environment, says Harold Schmitz, chief science officer for Mars.

Schmitz believes that the project, which will publish its findings publicly, could revolutionize food safety, but while IBM sees potential to build businesses around the data, it’s not yet clear how that possibility will flow to IBM’s bottom line.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.